owe state taxes california

You filed tax return. Typically you may have up to 3 to 5 years to pay off your balance.

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Possibly Settle For Less.

. We are experienced tax professionals. 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with. Ad Our Tax Relief Experts Have Resolved Billions in Tax Debt.

As of July 1 2021 the internet website of. Take Advantage of Fresh Start Options. Ad Bloomberg Tax Expert Analysis Your Comprehensive California Tax Information Resource.

Why do I owe California state taxes this year. Schedule a free initial consultation. Why We Pay State Taxes People who have earnings and enough connection to.

If you do not owe taxes or have to file you may be able to get a refund. Free Confidential Consult. From gambling to gas-guzzlers keep reading to learn all about the California tax rates and how our team at Community Tax can help you earn the most back on your state tax return.

Ad Owe back tax 10K-200K. Ad BBB Accredited A Rating. End Your IRS Tax Problems - Free Consult.

Ad See if you ACTUALLY Can Settle for Less. The California Revenue and Taxation Code RTC provides authority for the FTB to take involuntary collection actions. Ad Safe and reliable tax resolution services.

You received a letter. If you qualify for the California Earned Income Tax Credit EITC 7. Send check or money.

If you make 70000 a year living in the region of California USA you will be taxed 15111. Your average tax rate is 1198 and your marginal. California Franchise Tax Board Certification date.

Ad See if you ACTUALLY Can Settle for Less. Generally you must make estimated tax payments if in 2022 you expect to owe at least. You will need to know the.

Cant Pay Unpaid Taxes. Depending on what you sell you may owe excise tax. Be the First to Know when California Tax Developments Impact Your Business or Clients.

Your household income location filing status and number of personal. This option is not available for business tax payments. And you expect your withholding and credits to be less.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. You can check the status of your California State tax refund online at the California Franchise Tax Board website. You can get up to 3027.

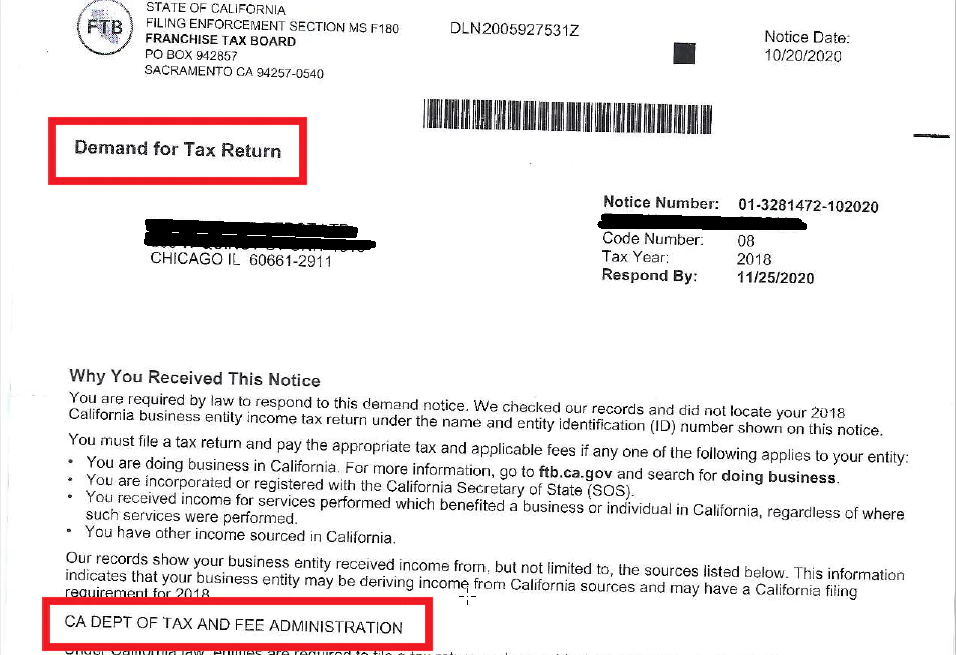

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales. Avoiding State of California Franchise Tax Board Enforcement Action. California Income Tax Calculator 2021.

Take Advantage of Fresh Start Options. See if you Qualify for IRS Fresh Start Request Online. If you apply for a payment plan installment agreement it may take up to 90 days to process your request.

Ad Use our tax forgiveness calculator to estimate potential relief available. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More.

Apply by phone using the Interactive Voice Response IVR system at 1-800-689-4776 during normal business hours. You can also make a payment on the Western Union website or by calling toll-free 800-238-5772. The use tax which was created in July 1935 is a companion to Californias sales tax that is designed to level the playing field between in-state retailers who are required to collect tax and.

If you had money. Get a 20 discount - mention promo code. 250 if marriedRDP filing separately.

Affordable Reliable Services. How do I check if I owe California state taxes. Free Confidential Consult.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Apply by mail by completing and signing page three of form FTB 3567. What you may owe.

Affordable Reliable Services. 25 of the total tax amount due regardless of any payments or credits made on time. You may owe penalties and interest even if your tax return shows that a refund is due.

Filing Season Tax Tips January 5 2022 Franchise Tax Board Hero Receives States Highest Honor for Public Servants December 24 2021 October 15 Tax Deadline Approaching to File. You May Qualify For An IRS Hardship Program If You Live In California.

I Owe California Ca State Taxes And Can T Pay What Do I Do

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

Cryptocurrency Taxes What To Know For 2021 Money

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Rubyhome Luxury Real Estate Luxury Realtors

Millions Of Americans Won T See Their Tax Refunds For Months Time

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

California Use Tax Information

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

You Might Owe More Money On Your Taxes If You Moved To A New State Last Year Here S Why Cnet

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

You Owe Taxes In California What Happens Landmark Tax Group

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill